|

SLAI Resources That Support Filing & Compliance |

|

Slai.org is your go-to source for EFS access, the Tax Calculator and reference materials you may need throughout the year. Bookmark the site and familiarize yourself with available tools and resources. |

|

|

|

|

|

|

|

EFS |

|

Submit policies and endorsements and access filing records and tax statements. |

| Take me there » |

|

|

|

Tax Calculator |

|

Estimate Surplus Line and Fire Marshal taxes based on premium, |

| Take me there » |

|

|

|

Coverage Code Lookup |

|

Confirm correct coverage codes to reduce filing errors |

| Take me there » |

|

|

Correction Guidance |

|

Step-by-step instructions for correcting previously submitted filings |

| Take me there » |

|

|

|

These tools are available year-round to support accurate filings and reduce delays. |

|

|

|

|

|

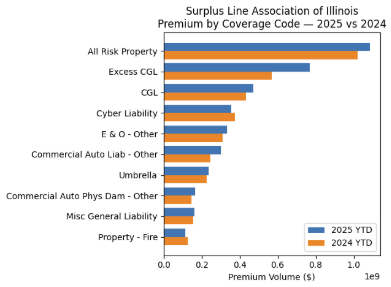

2025 Illinois Surplus Lines Market – At A Glance |

|

|

|

|

Top Lines of Business |

-

All Risk Property

-

Excess CGL

-

CGL

-

Cyber Liability

-

E & O - Other

-

Commercial Auto Liab - Other

-

Umbrella

-

Commercial Auto Phys Dam - Other

-

Misc General Liability

-

Property - Fire

|

|

|

Top Surplus Lines Insurers |

-

Lloyd's of London

-

Lexington Insurance Co

-

Liberty Surplus Insurance Corp

-

National Fire & Marine Insurance Co

-

Starr Surplus Lines Insurance Co

-

Columbia Casualty Co

-

Endurance American Specialty Insurance Co

-

Allianz Global Corporate & Specialty SE

-

Indian Harbor Insurance Co

-

AXIS Surplus Insurance Co

|

|

|

|

This information is provided for awareness and context as the market continues to evolve. See more 2025 Illinois Surplus Line data by clicking here. |

|

|

|

|

|

|

|

Staying Connected in 2026 |

|

|

|

|

Follow us on social! |

|

|

|

|

Compliance doesn’t stop after February. To stay informed throughout the year:

-

Read SLAI emails – they contain required actions and deadlines

-

Use slai.org tools – especially before filing or correcting submissions

-

Follow SLAI on Linkedin, Instagram and Facebook for reminders, resources and industry updates.

|

|

|

|

Your engagement helps ensure smoother filings and fewer issues. It allows SLAI to better support our members statewide. |

|

|

|

|

|

|